THE ADVISER’S NOTEBOOK

November 2025

Welcome to the November Edition of the Adviser’s Notebook!

As we move into the final stretch of the year, November is a valuable time to pause, reset, and plan thoughtfully before the holiday season begins. It’s a month where life can start to speed up; socially, financially, and in markets so taking a moment now to reflect and prepare can make the months ahead feel a little smoother and more intentional.

This month, we’ve also included a quarterly investment update for insights into how the third quarter of 2025 has performed.

Alongside the update, you’ll find articles focused on our November theme: Pre-Holiday Budgeting & Smart Investing including practical strategies for managing spending, keeping debt in check, and maintaining your investment discipline even through a busy season.

Lastly, I also wanted to share a quick personal note, I have been recognised for the fourth consecutive year for the 2025 FS Power50 list. I’m genuinely grateful for the acknowledgement, but even more so for the trust you place in myself and the Your Wealth Hub Advice team. The real reward is the work we do together every day, helping you make confident, values-based financial decisions for your life and family. Thank you for being part of this journey.

As always, if anything in this month’s newsletter gets you curious about how these global trends impact your portfolios or if you want to discuss what these developments mean for your goals, please reach out. We're always here to provide guidance and support.

Warm regards,

Gavin Glozier, Grad Dip, Fin Plan

CEO & Principal Financial Adviser

P 1300 763 498 • M 0408 155 140

Level 17, Angel Place, 123 Pitt Street, Sydney NSW 2000

Live the life you want to live.

Q3 Market Snapshot: Key Trends Shaping Investments

The third quarter of 2025 delivered broadly positive results for investors, with global markets buoyed by momentum in technology and AI, easing moves from key central banks, and strong performance across Australian resource and export-linked sectors. While this has supported diversified portfolios, it's also a moment to remain thoughtful: valuations are elevated, inflation concerns haven’t fully disappeared, and global trade dynamics continue to evolve. This update provides a clear snapshot of what drove recent market strength and what to watch as we head into the final stretch of the year.

Click to gain perspective on how these trends may influence your portfolio and the opportunities ahead.

Don’t Dive Into The Holidays With Unnecessary Debt

It’s no secret: the end-of-year festivities often bring extra expenses: gifts, travel, social events; and for many Australians that means more debt. This cheat sheet from Mozo offers a simple yet effective roadmap to navigate the season without compromising your financial health. You’ll find practical moves like creating a dedicated “holiday war chest”, setting a realistic gift budget, and identifying quick savings opportunities so you can enjoy the celebrations with less stress and more control. Click through to get ahead of your spending, protect your savings, and start your summer season from a position of strength.

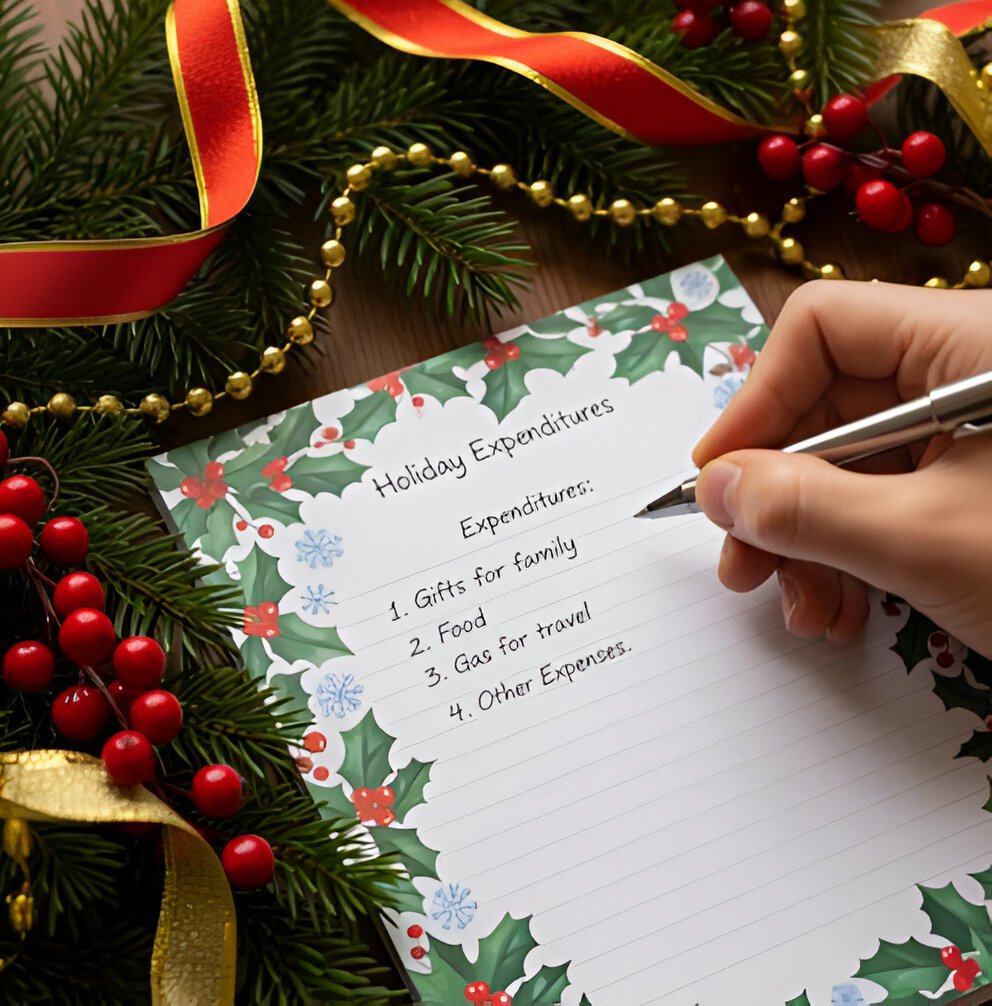

Plan Your Christmas Spending Before You Splurge

It’s no secret: the end-of-year festivities often bring extra expenses: gifts, travel, social events; and for many Australians that means more debt. This cheat sheet from Mozo offers a simple yet effective roadmap to navigate the season without compromising your financial health. You’ll find practical moves like creating a dedicated “holiday war chest”, setting a realistic gift budget, and identifying quick savings opportunities so you can enjoy the celebrations with less stress and more control. Click through to get ahead of your spending, protect your savings, and start your summer season from a position of strength.

Holiday Spending Gets A Reset

New research shows that nearly half of Australians are planning to pull back on their holiday spending this year, prioritising savings and value over excess.

If you’re looking to start the season strong and avoid common spending traps, this article is a timely reminder to plan thoughtfully, spend with intent, and keep your financial health intact.

Optimise Your Investing As A Couple

As we head into the holiday season, many couples start thinking about budgets, shared expenses and long-term financial goals. This article explores how the way you structure your investments as a couple can directly impact your after-tax returns and ultimately, how much money you keep. From choosing whose name investments should be in, to managing tax brackets and super contributions, small structural decisions today can support smarter spending and stronger savings later. A timely read for couples wanting to make confident, intentional financial choices heading into the new year.

What Lower Rates Could Mean For Your Financial Strategy

Even though interest rates have started to ease, new insights suggest the effects may roll through the economy more gradually than expected. Rather than relying on rate cuts alone to boost spending power, this is a timely reminder to review your financial strategy — from how you manage repayments to how you allocate savings and investments. Taking a proactive approach now can help you stay ahead and make the most of a shifting rate environment. Click to read how evolving rate settings could influence your next financial move.